Like other Japan’s leading cosmetics makers, - such as Shiseido or Pola - Kanebo Cosmetics, belonging to the Kao group since 2006, has resolutely entered into a strategy of international development. Currently, Kanebo achieves 90% of its turnover in Japan and only 10% abroad. "Our first objective is to reach 15% as quickly as possible", explains Shinji Yamada, Director of the international PR Department of the Group.

Reduce its dependence towards Japan

Confronted to a domestic market, which for the past eight years, has turned out to be totally lifeless, Japanese giants of the cosmetic industry have engaged themselves in massive international investments. And needless to say it was about time.

In fact, although they still use a lot of cosmetics, baby boomers which were a true goldmine to the Japanese industry have reached 60 years of age and since 2005, population has started declining. Even worse, consumption of cosmetics, which was known for its stability, has also shown, some signs of slowing down. From this point of view, with a drop in sales of 8.1% 2009 was an unprecedented year. Even if the situation has partially improved in the first half of 2010, with a volume increase of 1.32%, the market has continued to decline in value (-1.6% according to the Ministry of Economy).

Nonetheless, competition is not weakening on the Japanese market itself, quite the contrary. On the one hand, for Japanese companies looking for diversification, barriers to entry are low and many big players have recently set foot in the cosmetic market. These last years, the cosmetic offer has come from cosmetic players as unexpected as Fuji Films, with the Astalift brand or Ajinomoto, the food giant, and even Suntory, the famous Japanese beer maker, on the cosmetic food segment. On the other hand, the lack of dynamism of the Japanese market does not deter international brands who, given their low penetration rates, can rely on significant growth margins and are still eager to take their share of what remains the second global market.

Portfolio Rationalization

For Kanebo, the first step consisted in streamlining its brand portfolio to focus its resources on lines with a stronger international potential and explore new expanding growth markets.

From about sixty in 2004, Kanebo has reduced its portfolio to currently twenty lines, while new products were launched, especially in cosmetic food, or on the 60-something age segment with Chicca.

Focus on China and Asia

With the goal of becoming a real global player, Kanebo has segmented its international strategy in three levels: China, Asia and Europe-USA.

China is clearly the Group’s first priority which is carrying out in the country a large scale specific strategy based on six brands distributed through two channels: department stores (Lunasol, Impress, Coffret d’Or, and Aqua Sprina) and high-end drugstores and pharmacies (Free Plus and Kate).

Regarding the rest of Asia, excluding Japan, of course, Kanebo is focusing on a dozen countries, with a strategy hinged on its premium brands (Lunasol, Blanchir Superior, Impress, Coffret d’Or) and on department stores, and targeting as a priority markets such as Thailand, Malaysia, the Philippines, Indonesia and Vietnam, where this segment is experiencing the fastest growth (10% on average over the past three years, against 4.4% on average for Taiwan, Hong Kong and South Korea).

For Europe and the United States, the Group’s strategy remains centred on Sensaï, its "super prestige" brand, distributed in department stores, selective perfumeries and in spas of some hotels since the opening in December 2009 of the first Sensaï Select Spa at the Victoria-Jungfrau Grand Hotel of Interlaken in Switzerland.

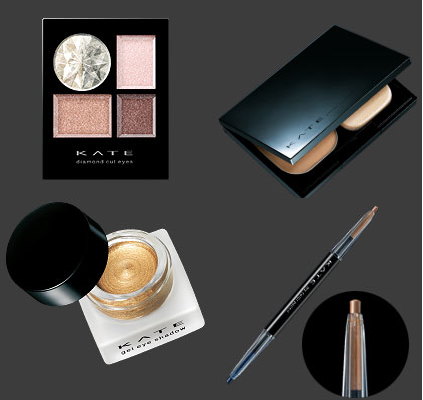

Launch of Kate in China

Kate, Japan’s leading make-up brand in the self-service beauty segment, debuted this month in Shanghai and Beijing. The brand is being launched at drugstores, starting with Watsons, Asia’s leading health and beauty retailer. The number of sales outlets is expected to grow from 20 stores in the first month to 50 stores by the end of 2010, and 100 by the end of 2011.

Kate mainly aims at young Chinese women born after 1980, a population that is reputed to highly appreciate Japanese trends in fashion and cosmetics. However, as self-service still has not taken root for beauty products in China, Kanebo has decided to provide Chinese consumers with the advices of beauty consultants in sales corners installed in the selected drugstores. Globalisation sometime means adaptation!